The wait is over for investors looking at the next big FMCG IPO 2025. Orkla India Limited, the company behind beloved brands like MTR Foods, Eastern Condiments, and Rasoi Magic, has announced its public listing plans. This Orkla India IPO brings one of India’s leading packaged food companies to the stock market for the first time.

The Orkla ASA India listing represents a major shift in the Indian FMCG landscape. As the Indian subsidiary of Norway’s Orkla ASA, this company has built a strong foothold in the domestic market over the years.

- [CAMERA]: Rear Camera: 200 MP Ultra-Clear Main Camera: OIS, f/1.88, FOV 84°, 6P lens 8 MP Wide-Angle Camera: f/2.2, FOV …

- [SCREEN & DISPLAY]: 17.20 cm (6.77″) Slim Quad Curved AMOLED Capacitive multi-touch Display | P3 wide colour gamut | 387…

- [MEMORY & SIM]: 8GB RAM | 128GB Internal Memory | LPDDR4X | UFS 2.2 | Bluetooth 5.4 | USB 2.0 | 5G + 5G Dual SIM Dual St…

Orkla India IPO Key Details and Timeline

Essential IPO Information

The Orkla India IPO date has been set for late October 2025, creating significant buzz among market participants. Here are the crucial details every investor needs to know:

IPO Structure: Complete Offer for Sale (Orkla India OFS)

Share Count: 2.28 crore equity shares (22,843,004 shares)

Orkla India IPO price band: ₹695 – ₹730 per share

Market Valuation: Approximately ₹10,000 crore ($1.14 billion)

Important Dates for Your Calendar

- Anchor Investor Bidding: October 28, 2025

- Public Subscription Period: October 29-31, 2025

- Orkla India BSE listing & Orkla India NSE listing: November 6, 2025

Orkla India IPO GMP Shows Strong Market Interest

The Orkla India IPO GMP (Grey Market Premium) currently trades between ₹55-₹65, indicating healthy investor appetite. This premium suggests that market participants expect the Orkla India share price to perform well post-listing.

The GMP reflects positive sentiment around this MTR Foods IPO, with investors showing confidence in the company’s brand portfolio and market position.

- 6.8″ Ultra-Bright, Eye-Caring Display: The 17.27cm (6.8 Inch) AMOLED screen delivers cinematic visuals with 1600 nits br…

- Pro-Grade Camera -Capture True Colors: 50 MP Main Camera and 2 MP Portrait Camera, and a sharp 32 MP Front Camera, this …

- Performance That Powers Every Moment with Snapdragon 7: Qualcomm Snapdragon 7 Gen 3 Mobile Platform × Trinity Engine To …

Understanding Orkla India’s Business Model

Brand Portfolio That Drives Growth

Orkla India operates three powerhouse brands that dominate specific market segments:

MTR Foods leads the ready-to-eat and instant mix categories, especially in South Indian markets. The brand has become synonymous with authentic South Indian flavors and convenience.

Eastern Condiments captures the spice and masala market with its wide range of products. This brand has established strong distribution networks across multiple states.

Rasoi Magic targets the instant curry and meal mix segment, appealing to busy urban consumers seeking quick cooking solutions.

Market Position and Reach

The company has built an impressive distribution network covering 6.9 lakh retail outlets across India. This extensive reach gives Orkla India a competitive advantage in the crowded FMCG space.

The focus on expanding beyond traditional South Indian strongholds shows the company’s ambition for pan-India growth.

Financial Performance Analysis

Strong Revenue and Profitability Numbers

Orkla India’s financial metrics paint a picture of steady growth:

- FY25 Revenue: ₹2,455 crore

- Net Profit: ₹255.7 crore

- EBITDA Margin: Around 17%

These numbers show the company maintains healthy profitability while scaling operations. The EBITDA margin reflects efficient cost management and strong brand pricing power.

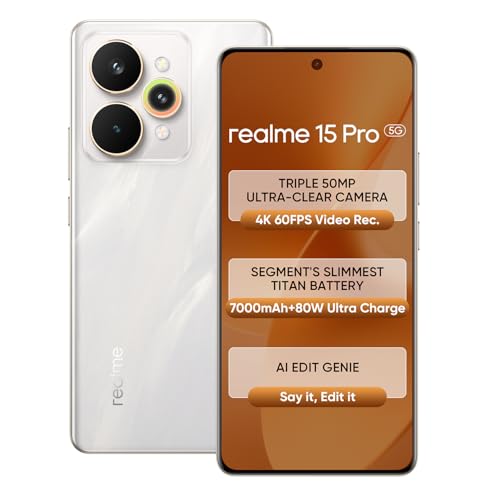

- Display: 144Hz HyperGlow 4D curved screen with 4K 60FPS support for clear, smooth visuals.

- Battery: 7000mAh capacity combined with 80W SuperVOOC for lasting power and quick recharges.

- Cameras: Triple 50MP rear cameras to capture detailed shots in various scenarios.

Strategic Growth Plans

Manufacturing Optimization

Orkla India plans to consolidate nine smaller manufacturing units into four or five large, efficient plants. This move should improve operational efficiency and reduce costs.

Distribution Expansion Strategy

The company targets adding 50,000-60,000 new retail touchpoints across India. This expansion will strengthen market penetration and improve product availability.

Innovation Focus

The company emphasizes ready-to-cook (RTC) and ready-to-eat (RTE) product categories. These segments align with changing consumer preferences for convenient food options.

Investment Analysis: What Investors Should Consider

Positive Factors Supporting Investment

The Orkla India news highlights several growth drivers that make this FMCG IPO 2025 attractive:

Strong Brand Recognition: MTR, Eastern, and Rasoi Magic enjoy significant consumer loyalty and market share.

Growing Market Opportunity: India’s packaged food market continues expanding as urbanization increases and lifestyles change.

Solid Financials: The company demonstrates consistent profitability and healthy margins.

Distribution Strength: Extensive retail network provides competitive moat and growth platform.

- Flagship-class Performance with MediaTek Dimensity 8350 Apex: Benchmark-breaking 1.47 million+ AnTuTu score and up to 12…

- 7100mAh – OnePlus’s Biggest Battery Ever with Bypass Charging: Up to 2.5 days of everyday use on a single charge – more …

- Dominate BGMI and CODM at up to 120 FPS: Ultra-fluid, lag-free gaming with high touch response rates gives you that spli…

Potential Challenges to Watch

No Fresh Capital: Since this is purely an Orkla India OFS, no new money enters the business for growth initiatives.

Intense Competition: Major players like Tata Consumer Products, ITC, and Dabur compete aggressively in similar categories.

Commodity Price Risk: Food companies face margin pressure when raw material costs rise sharply.

Regional Concentration: Heavy dependence on South Indian markets could limit growth if expansion plans face challenges.

Market Outlook for FMCG IPO 2025

The timing of this Orkla ASA India listing comes when investors show increased interest in consumer goods companies. The packaged food sector has benefited from changing consumption patterns and increased health consciousness.

Several factors support positive sentiment around this MTR Foods IPO:

- Rising disposable income drives premium product adoption

- Urbanization increases demand for convenient food solutions

- Brand loyalty in food categories creates stable revenue streams

- Export potential offers additional growth avenues

Orkla India Share Price Expectations

Given the current Orkla India IPO GMP of ₹55-65, market participants expect listing gains. However, long-term Orkla India share price performance will depend on:

- Successful execution of expansion plans

- Market share gains in new regions

- Innovation in product offerings

- Ability to maintain margins amid competition

- Flagship Performance with Snapdragon(TM) 8s Gen 3: Couple this with the latest LPDDR5X RAM and segment-leading VC coolin…

- Flagship 50MP Front and Back Cameras Born for the Night: Best-in-class clarity and natural-looking colors for selfies, p…

- Beast-mode 6800 mAh Battery + All-new Bypass Charging: Binge and game with up to 19.8 hrs of YouTube and 9.5 hrs of BGMI…

Should You Invest in Orkla India IPO?

This decision depends on your investment goals and risk appetite. The company offers exposure to India’s growing packaged food market through established brands with proven track records.

However, remember that this Orkla India OFS means your money goes to selling shareholders, not company growth. Evaluate whether the current valuation offers attractive entry point for long-term wealth creation.

Consider factors like:

- Your portfolio’s FMCG allocation

- Comfort with food sector cyclicality

- Belief in company’s expansion strategy

- Valuation compared to listed peers

Final Thoughts on Orkla India IPO 2025

The Orkla India IPO represents a significant opportunity to invest in one of India’s respected food companies. With strong brands, expanding distribution, and clear growth strategy, the company appears well-positioned for the public market debut.

- Rear Camera:50MP Sony IMX882 sensor + 2MP | Selfie Camera: 32 MP

- 17.20 cm (6.77″ inch) Display

- Memory & SIM: 8GB RAM | 128GB internal memory

The positive Orkla India news around this listing reflects market confidence in the business model and management execution. As we approach the Orkla India IPO date, monitor subscription numbers and institutional interest for additional insights.

Whether you’re interested in the Orkla India BSE listing or Orkla India NSE listing, this IPO deserves serious consideration from investors seeking exposure to India’s dynamic FMCG sector.

Remember to read the company’s prospectus carefully and consider consulting your financial advisor before making investment decisions. The Orkla India IPO price band of ₹695-730 per share will determine final valuation, so track developments closely as the listing date approaches.

Disclaimer: “As an Amazon Associate, I earn from qualifying purchases”

🛑 Disclaimer

The information provided in this article is for educational and informational purposes only. It is based on publicly available data and reliable sources at the time of writing. We do not guarantee the accuracy or completeness of any information presented here.

This article does not constitute financial or investment advice. Readers are strongly advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

askwritings.in and its authors are not responsible for any financial losses or damages arising directly or indirectly from the use of the information provided in this post.